Dipping your toes into the world of cryptocurrency is exciting, but knowing how to withdraw your money, especially USD, from an exchange like Binance can be a real reward. Whether you’re making a big profit from your last trade or simply transferring money to your bank account, this guide will take you through each step with ease. Let’s get started!

Step 1: Verify Your Account

First things first: if you want to withdraw money from Binance, your account must be verified. Why? Well, for safety and regulatory reasons. Think of it as a bouncer checking IDs at a club. Binance wants to make sure that everyone who withdraws is who they say they are.

For verification, you need to upload some basic documents like passport or driving license and address proof. This may seem like a hassle, but this step is a one-time process. Once verified, you’re ready for the future!

Step 2: Checking Available Balances

Well, you’re approved! Next, you need to confirm that you have enough USD in your balance to withdraw. Sometimes people forget to convert their cryptocurrencies to USD. Don’t worry – it’s easy! Just go to Wallet and check your USD balance.

If you own other cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), you should sell them or convert them to USD. Binance has a simple way to do this. For example, if you have $500 worth of BTC, you can instantly convert it to USD.

Step 3: Choosing a Withdrawal Method

This is where the magic happens. Binance offers several ways to withdraw USD, each with its own advantages and disadvantages. The main methods are:

- Bank transfer

- Credit/Debit Card

- Peer-to-Peer (P2P) Transfer

- Third party wallets

Choosing the right method depends on factors such as speed, fees and convenience. Let’s review each option to find your perfect match.

Step 4: Bank transfer method

Bank transfers are one of the most common ways to withdraw USD from Binance. You simply link your bank account, enter the withdrawal amount and voila – your money is on its way. This method usually takes 1-5 business days depending on your bank. The upside? It is safe and reliable.

However, there may be fees that vary by region. For example, a typical bank transfer fee on Binance in the US can be around $15, so it’s a good option for larger withdrawals.

Step 5: Withdraw from Debit or Credit Card

Want your funds faster? Withdrawing money to a debit or credit card can be a faster option, often taking just a few hours a day. Think of it as ordering express delivery for your money. However, there is a trade-off: card withdrawals sometimes come with higher commissions (usually 1.8-2%).

This method is a good option if you are willing to pay a small fee in exchange for speed. Just make sure your card is eligible for this kind of transfer on Binance!

Step 6: P2P (Peer-to-Peer) Method

Here’s a fun alternative: Binance’s P2P (peer-to-peer) platform. P2P allows you to connect directly with other users who want to exchange US dollars for local currency. It’s like meeting someone on Craigslist, except in a much safer way.

The big plus here is that P2P trading can sometimes come with zero fees and they are fast. But remember that you are responsible for finding a reliable buyer – Binance provides an escrow to secure your funds until both parties confirm the transaction.

Step 7: Third party wallets and payment services

If you prefer the flexible route, Binance also supports withdrawals to third-party wallets such as PayPal or Skrill. Although not available everywhere, this method is gaining popularity due to its convenience. For example, PayPal may charge a small conversion fee, but it’s usually quick and easy.

Step 8: Enter withdrawal details

Once you’ve chosen your withdrawal method, it’s time to enter your bank or card details. Triple check everything – mistakes here can cause delays or even a failed transfer. No one wants to repeat this step!

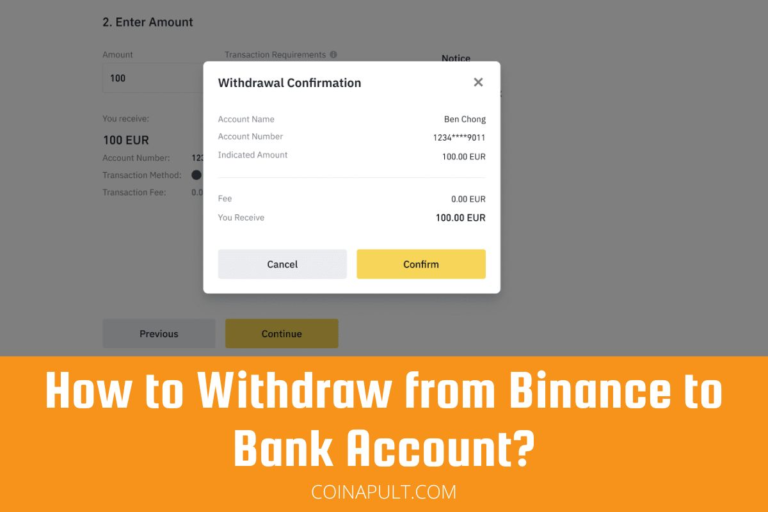

Step 9: Review and confirm the removal

After entering your details, take a moment to review. Binance will usually ask for a two-factor authentication (2FA) code to complete the transaction. It’s like double-checking that you’re the right person. Once approved, your withdrawal request is officially ready!

Step 10: Monitoring Extraction Status

Now let’s talk about patience. Binance allows you to track the status of your withdrawals in the Transaction History section. Withdrawals can be pending, in progress or completed. If you see “pending” longer than expected, it’s usually just processing time. But if stuck, don’t hesitate to contact Binance support.

Common Extraction Problems and Solutions

- Verification Delays – If your account is not verified, withdrawals will not be made. Make sure all documents are up to date.

- Insufficient balance – Make sure you have enough USD on hand.

- Network Delays – Sometimes network issues can slow processing times. If this happens, Binance will let you know.

Binance Withdrawal Fees Explained

Let’s talk money. Binance fees vary by method:

- Bank transfer – About $15 per transfer.

- Credit/Debit Card – Typically 1.8-2% of the amount.

- P2P – There is usually no charge, but rates may vary.

- Third party wallets – Conversion fee may apply.

Although these fees are not very high, it is wise to be aware of them in order to make the best decision.

Alternative ways to access US dollars

If Binance’s fees or options don’t suit you, there are alternatives:

- Crypto ATMs – They allow direct cryptocurrency to cash exchange if available near you.

- Other Exchanges – Platforms like Coinbase also offer USD withdrawals.

Conclusion and Final Tips

Withdrawing USD from Binance is not difficult. Once your account is verified and you’ve chosen your preferred method, everything else is easy. Whether you use a service like bank transfer, P2P, etc https://predictwallstreet.com/ or a third-party wallet, Binance offers enough flexibility to meet almost any need. Just remember to focus on payments and don’t hesitate to contact support if you run into problems.