Introduction to the Child Tax Credit Expansion

In recent discussions, Congress is contemplating another expansion of the Child Tax Credit. This initiative aims to provide financial relief to families across the nation, even if the boost is less substantial than previous enhancements.

The Importance of the Child Tax Credit

The Child Tax Credit has been a vital tool for alleviating poverty amongst children in American families. It has played a significant role in supporting families, helping them afford necessities like food, clothing, and education.

Details of the Proposed Expansion

The new expansion proposed by Congress is marked by a smaller increase than prior iterations. While some families may welcome even a modest increase, the reduced amount has sparked discussions on its sufficiency to meet the needs of struggling households.

Comparison with Previous Expansions

Previous versions of the Child Tax Credit provided a more substantial temporary boost during the COVID-19 pandemic. Families received up to $3,600 per child, a significant increase aimed at providing immediate relief.

Impact on Families

For families, any increase, no matter how small, is still beneficial and can make a difference in their financial stability. However, the current proposal raises questions about whether the smaller boost is sufficient to address the ongoing economic challenges faced by many.

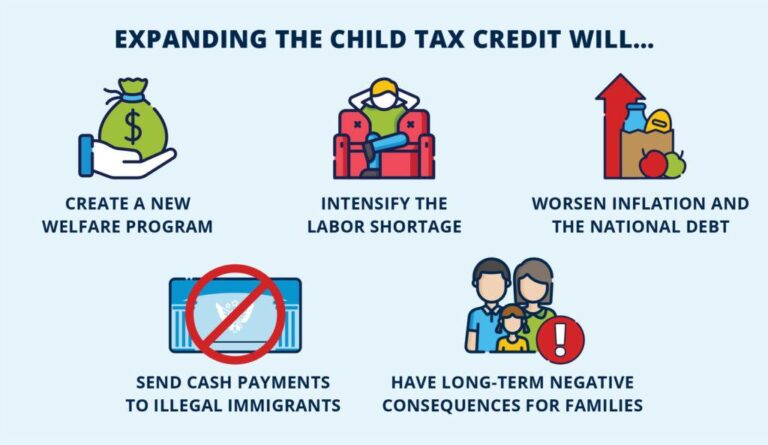

Political Considerations

The push for this credit expansion comes amid fierce political debates and negotiations. Lawmakers are weighing the impacts of such financial support against the backdrop of budget constraints and differing party agendas.

Public Reactions and Advocacy

Advocacy groups are calling for larger boosts as they emphasize the continuing needs of families. Many citizens and organizations are voicing their opinions on the importance of comprehensive support to ensure every child has the opportunity to thrive.

Conclusion: Looking Ahead

As Congress moves closer to finalizing the details of the Child Tax Credit expansion, the nation watches closely. The potential changes hold implications for millions of families, and discussions are ongoing about the best ways to provide meaningful support.

For more information on the current status of the Child Tax Credit and related developments, you can read more here.